Maybe QuickBooks does everything you need. But if you outgrow parts of it, don’t worry, you’ll have options.

What do you do when an application you’re using stops meeting your growing needs in a specific area? You can: a.) find a workaround, b.) switch to different software, or, c.) resign yourself to living without that feature.

QuickBooks offers a fourth option: d.) find an integrated add-on app that will work for you. There are hundreds of them available, so it’s likely you’ll find one that will do just what’s needed. They fall into several categories, ranging from billing and invoicing to Customer Relationship Management (CRM) to inventory management to time-tracking. They have special versions designed to work with QuickBooks, and they require a monthly subscription fee.

We’ll look at three of the most popular in this column. If you’ve never worked with integrated applications before (and even if you have), we recommend that you let us help get these set up and running for you since their operations can be confusing at first.

Expensify

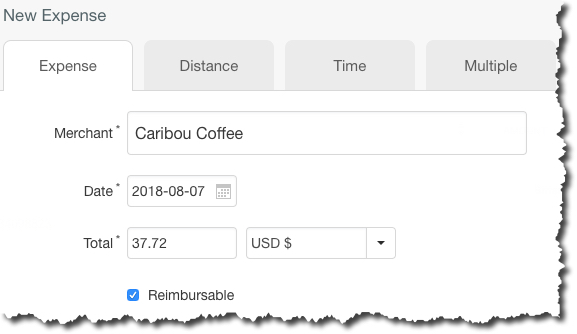

From receipt tracking through reimbursement, Expensify automates the process of managing expense reports. You snap photos of receipts, and the site’s built-in intelligence will read them and enter details like merchant, date, and price in the system’s own forms. If you need to record vehicle mileage, Expensify can do that by using your smartphone’s GPS. Other features include compatibility with global currencies and taxes; notifications of travel itinerary changes; “smart” receipt-auditing (ensuring that your expense policies are enforced); and direct deposit reimbursements.

You can enter expenses manually in Expensify or take a photo with your phone. The site will read the receipt and transfer critical data to forms in the app.

The service offers three price levels for small business. For $5 per user/month, you get tools that enable basic expense approval and online reimbursements. A Corporate subscription gives you that, plus advanced policy support, corporate card reconciliation, and a multi-staged approval workflow, for $9 per user/month.

method:CRM

method:CRM was actually built exclusively for QuickBooks users. It expands on the customer management tools found in QuickBooks and supports two-way synchronization. You can see real-time customer, lead, and vendor data in either application; automate lead-collection and lead-tracking; and service customers far more efficiently than with QuickBooks alone. The application saves time by streamlining workflows and eliminating duplicate data entry, and its customer and vendor portals provide safe online spaces where you and your contacts can interact, view transactions and other information, and make payments.

After a 30-day free trial, you can subscribe to one of two levels. The Contact Manager version ($28 per user/month or $25 if paid annually) offers everything with the exception of the ability to create QuickBooks sales transactions, accept online payments, and track your sales pipeline. These tools are included in CRM Pro ($49 per user/month or $44 if paid annually). Some services are available a la carte.

Bill.com

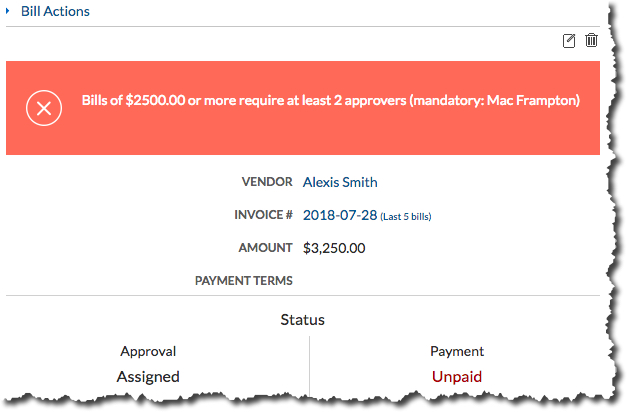

If you only process a couple dozen bills and invoices every month, QuickBooks may be all you need. But if you have complex, transaction-heavy accounts receivables and payables that are difficult to track, you might want to consider Bill.com. A web-based application that integrates very well with QuickBooks, Bill.com is all about automation. It offers multiple ways to get your sales and expense documents into a digital format (scan, fax, email, smartphone photo) and then follows your directions as it routes them to the appropriate employees for approval. You’ll make and receive payments electronically and always know where you stand with customers and vendors, thanks to a simple, understandable user interface and navigation scheme.

Pricing starts at $39 per user/month, which includes accounting software integration and your choice of payable or receivable support. You can get both for $59 per user/month – plus advanced automation and approver options.

Many More

There are hundreds of others, in more targeted areas like human resources, reporting, shipping, and e-commerce. You can search or browse through the library of solutions here.

If the integrated apps we described here sound too complicated for you, you may not need them. Or perhaps you do need them but you’re not sure you could master them easily. That’s where we come in. We would first determine whether you’re using all of QuickBooks’ own tools in the problem areas you’ve identified. Then we’d introduce you to your options in that category and help you get up and running.

QuickBooks was designed for small businesspeople, but that doesn’t mean that you’re going to understand all of its parts and how they work together instantly. So, contact us if you need assistance. We want your business to thrive, and having a clear understanding of your financials is essential to that success.