Accepting payments through Intuit is more than convenient and time-saving: It can improve your cash flow.

How did your cash flow fare during 2014? If you’re scrambling to end the year in the black, you should probably be thinking about changes you can make in 2015 to improve your bottom line.

One way is by starting to accept credit and debit card payments – and ACH bank transfers – through QuickBooks. Customers who might wait to pay your invoice until their own cash flow is better might be more likely to settle their debt by using a credit card.

Plus, it’s just simpler than digging out a checkbook, writing a check, putting a stamp and return address label on the envelope, and mailing it. Even if a customer’s cash flow is OK, they may choose the bank card option because it’s easier and faster.

There’s a certain amount of setup work involved in signing up for QuickBooks Payments, a brief application and some decisions to make. It’s not difficult, but if you’re new to merchant accounts, let’s sit down together and go over what’s involved.

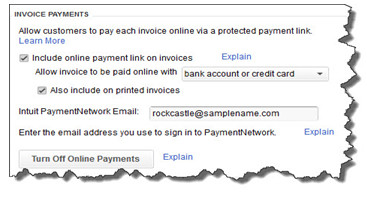

Figure 1: You’ll click on Edit | Preferences | Payments | Company Preferences to work with your QuickBooks Payments options.

Do I have to sign a contract?

No, there are no termination fees.

Can I use my regular bank?

All major banks and many smaller ones support merchant accounts. It shouldn’t be a problem.

Do I need a special version of QuickBooks to set up payments?

No. The tools you’ll need are built in.

How will my customers know that I’m beginning to accept credit cards?

They’ll follow the Pay Now link that comes with their invoice. This will take them to a secure site where they can enter their credit card numbers. If you’d like, you can send them an email ahead of time notifying them of the new service.

Do I have to have a card reader/swiper to accept credit cards?

No. You can purchase one and use it, which will reduce your service fees. But it’s not required.

What kinds of payments are accepted?

QuickBooks Payments will accept all major credit cards: Visa, Mastercard, Discover, and American Express. Your subscription also supports bank transfers.

What if I want all large payments to be made by bank transfer only?

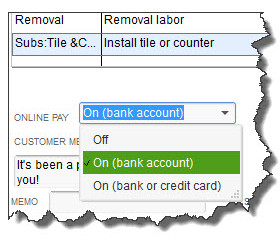

You’ll have control over how each invoice is paid, which you can specify on the invoice.

Figure 2: When your QuickBooks Payments account has been activated and you’ve done the setup necessary, you’ll be able to choose what type of payment will be accepted on each invoice.

Do I still have to enter these electronic payments into QuickBooks?

No. Your company file will be auto-updated with the payment information.

How soon do I have access to the money?

Funds are usually available within 2-3 days.

Can I accept payments on my mobile device?

Yes, using an Intuit app called GoPayment.

What does it cost to be able to accept credit/debit cards and bank transfers?

There are three options:

- Standard Rates: No monthly fee. $2.40% + 25 cents per swiped transaction. 3.40% + 25 cents if card number is typed in

- Reduced Rates: $19.95/month plus 1.75% + 25 cents per swiped transaction. 3.15% + 25 cents if card number is typed in.

- Bank Transfers: 50 cents per transaction for both plans

QuickBooks Payments simplifies your bookkeeping and helps prevent errors and duplicate data entry. It saves you time and money because of this, and it reduces your trips to the bank.

There’s more you need to know about accepting credit/debit cards and bank transfers in QuickBooks, like how to use the Merchant Service Center. If you’re in a resolution-making mood, we recommend you consider adding this capability to your accounts receivable in 2015, and we’d welcome the opportunity to talk with you about it.